People always have a desire to buy a home, but this is one of the most compromising decisions in anyone’s life. Still, there is a big need for assistance, which can be given by such a tool as a home loan calculator. This tool allows you to illustrate how much in installments you will be giving every month should you seek a loan for your house. It is really easy to use and, within a very short time, one will be able to work out the financial position.

What is a home loan calculator?

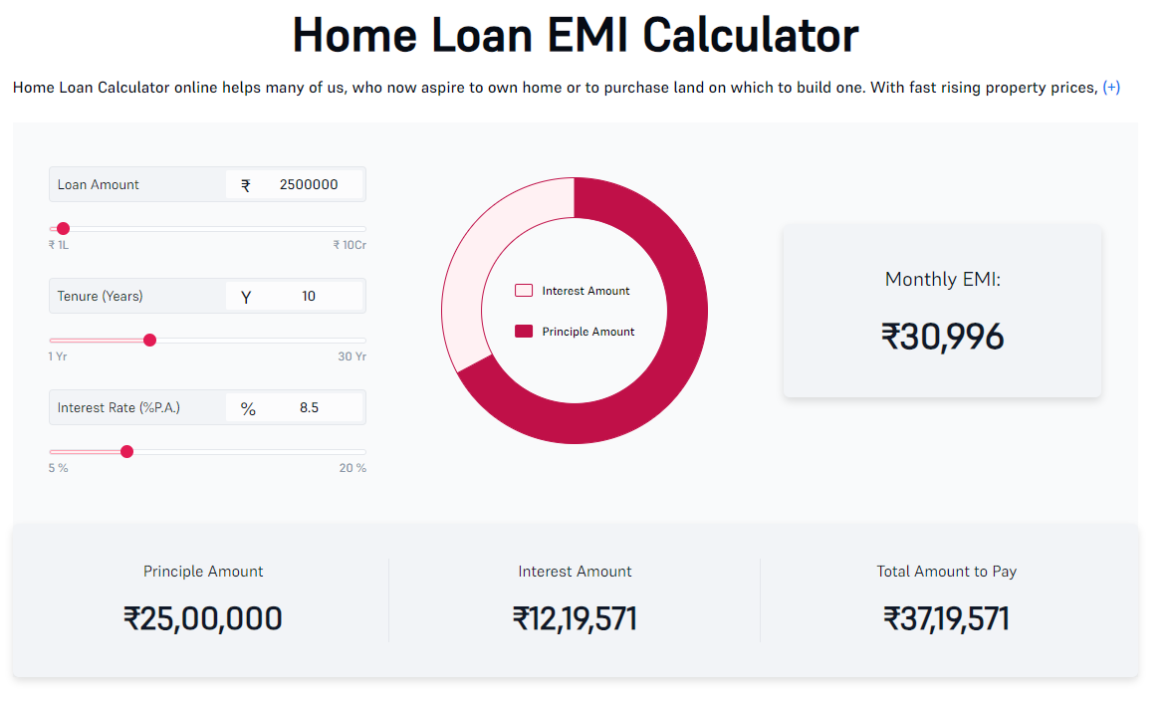

It is an online facility that calculates the approximate monthly installments for a loan. The facility requires the loan amount, the rate of interest, and the tenure of the loan so that it can give the approximate EMI to be paid every month. It’s when you have decided whether you can manage to pay for the loan and put the amount being charged in your budget.

Why you should use a home loan calculator

Easy planning: This home loan calculator helps you see what the cost will be every month. In this regard, you will get to make your budget way in advance. There will be no failure when you want.

Compare loans: Using the calculator, for example, one can easily switch between two competing loans and apply different interest rates or alter the amount of the loan. This allows the borrower to select the most suitable loan concerning his or her needs.

Rapid calculations: The formulas involved in these calculations are quite complex. The results appear immediately when making calculations with the help of this tool. This saves a lot of time and energy thereby.

Important things to consider

Before making loans accessible, there are a few factors to think about:

Down payment: They often come off as the first installment, but in simple terms, it is the amount of money that you’re going to pay as a down payment.

Interest rates: Interest rates are another factor, and a slight increase in your interest rate will make a huge difference in your monthly installments.

Loan tenure: Longer tenure of the loan lowers your EMI but, in the process, raises the total interest one has to pay in the long end. A short duration to pay the amount raises your EMI, but the total interest that one has to pay is lower.

Explaining HRA and home loans

Being a tenant, you may find it rather easy to comprehend and grasp this term known as House Rent Allowance – commonly abbreviated as HRA.

So, if you get paid every month, then HRA is what is being set aside from your salary for paying your rent. If you buy a house and avail of a home loan, you will not pay rent anymore; you will pay your EMIs.

Both are equal in terms of need, especially when it is time to buy a house.

HRA calculators can be used to determine the extent to which one can claim his rent amount in the form of tax deductions. This will save you some money, especially since you have to pay both rent as well as the home loan EMI.

Conclusion

Summing up, a home loan calculator or hra calculator is crucial when people need to make proper financial decisions. They remove confusion from problem-solving and provide you with solutions. To find more modes and tips about how to manage your money properly, you can visit 5paisa for better financial solutions.